“Jumbo Shrimp”

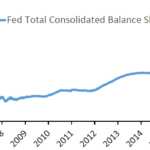

Having closed out another very impressive year for risky assets, investors turn their attention to the upcoming quarters as they search for signs that will provide clarity and predictive powers. The unprecedented involvement of the Federal Reserve in our financial markets, though, has muddied the typical metrics in which many investors have historically found comfort. In the equity market, investors often focus on ratios such as price-to-earnings, price-to-book, and price-to-sales, while also employing models like the discounted cash flow approach. Interest rates have a meaningful influence on valuations of all assets, with the U.S. dollar rates always being the primary benchmark across global markets.